One of the first but crucial steps in starting a business is the capital. You need to have sufficient funding in order for your business to operate and without the capital expenditure, we won’t have the funding to purchase all the needed items, products, and amenities to for our business.

We won’t have the power to hire human resources either which will, in return, help sustain our business. Gaining capital is proved to be a challenge, especially for young startup business owners because they mainly have to sacrifice a portion of their hard-earned savings and invest it as a capital for their business.

Many young business owners have no other option but to apply for business loans.

Oftentimes, savings capital aren’t even enough to fund your business. This prompts our young business owners to go to financial institutions in order to acquire a business loan. A business loan can help young entrepreneurs to fund their business while paying the interest rates on installment. Banks are known to be the top choice for business loans but with its strict requirements and tedious process, it takes a while before your business loan applications get approved. Is there a remedy for this? Well, we’ve got good news for you! Young entrepreneurs can now get their business loan easier because banks have started easing the process of application.

American Banks Are Now Easing the Process of Business Loans Application

Before the full implementation of this new business loan process, the senior officer for Federal Reserves conducted a study during the fourth quarter of the year 2017. They first pictured out a scenario on what will happen if all the banks across the country will lift up their process on business loan applications. The result of the said survey was warming and astounding. It gained a positive feedback from the masses, especially to those young entrepreneurs and aspiring business owners. The banks are set to ease their standards and process in GSE-eligible, small enterprises, and micro businesses.

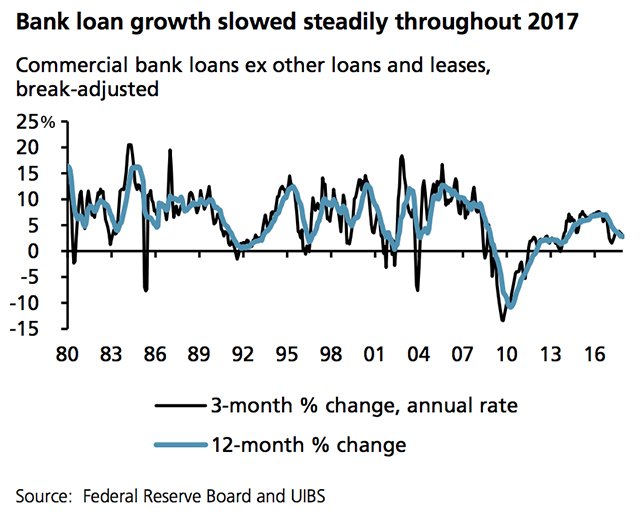

The Slow Growth Rate of Bank Business Loans For the Past Few Years

They are hoping that this new movement will put a halt and active recovery to the diminishing rate of business loans on bank institutions. The study and the latest move was conducted in order to recover the loss of bank institutions when it comes to profit and net income from business loans. The Economist noted that the bank’s lending power had reduced to 3% annual rate during the last quarter. This has been the lowest annual rate growth compared to the steady rate of 7% p.a. since 2015. If this keeps up (without the banks doing anything to reverse the current pace), the banking loans may plummet and deteriorate this year.

Economist's Insights About Bank Business Loans

That’s why the economists are welcoming this latest move from the banks in hopes of active recovery. Aside from that, the easing process for business loans is just in perfect timing with the newly passed Republican tax law. The new federal tax law will ease the business tax of business owners. This, in turn, will increase the business owner’s financial power as well as raise their capital funding for their business. If they have more money to save, they’ll be able to apply for bigger business loans because they can pay for the capital and interest rates efficiently.

However, Banks Are Expected to Tighten Up their Process on Credit Card and Real Estate Loans

In return to easing up the process of business loans, consumers may be in a tight spot because the banks will be tightening up their process in acquiring consumer loans such as credit card loans and real estate loans. The standard procedure for mortgages and consumer loans will remain unchanged. This means that auto loans, mortgages loans, and consumer real estate (either for personal or commercial) will be affected by the tightening up of standards and process.

Banks May Tighten Up Consumer Loan Application and Approval Though

However, the consumers responded with a mix reaction about the tightening process of consumer loans. While they’re positive and optimistic about the business loans, it may also affect their lending powers when it comes to consumer loans. Only time will tell how this latest move will affect the banking industry for the next few months or upcoming years. However, despite the setbacks and doubts, the banks are still expecting of a positive overall economic outlook of this latest movement.