New year comes with the prospect of starting over with a clean slate and finally getting your life and your finances back on track – but the new year also comes with overwhelming financial responsibilities and you often have to juggle several things at once including credit card statements, rent payments, insurance premiums and all sorts of bills.

Having so much on your plate can become stressful and discourage you from meeting all your new year goals. If you want to have more control over your personal and financial life, you may have to start by simplifying things and completely decluttering your life so that it’s easier for you to focus on things that actually matter.

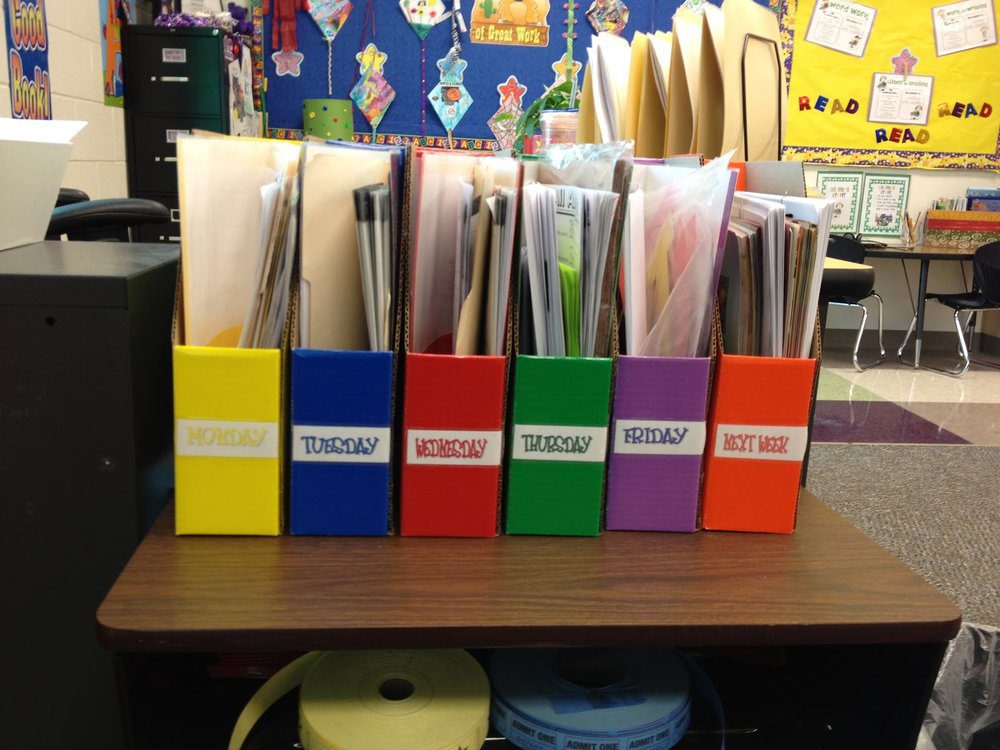

Spend half an hour a day organizing your things

Having a clean and organized environment can take away distractions and make you more productive

Before you can begin to sort out your financial or emotional clutter, it makes sense to clear out the physical mess around you which can often become a source of anxiety and prevent you from being productive. Working in a messy environment is highly undesirable since it can become a major distraction, which is why you need to dedicate a small chunk of your time to organizing – even half an hour each day will do.

You can start by sifting through the obvious places in your house and getting rid of anything that you think is unnecessary. You don’t have to do everything at once. Simply put aside 30 minutes daily to tackle one small area of the house and take things slowly from there. Besides, you’re more likely to put off cleaning if you’re anticipating to do all of it at once.

Declutter your bank accounts

Pipeline all your bill payments through a single account so that you don’t miss a deadline and keep track of your expenses

Mortgage payments, auto loan payments, insurance premiums, utility bill payments, rent payments – there are so many bills to pay, and the only way you can keep track of them is by automating all the payments through a single bank account. Make sure to calculate how much money you need to have in your account for the payment so that you don’t have run into a cash shortage problem when the time comes to tackle these bills. Your bank might also offer a service to automatically pay the bills from your account each month so you don’t have to worry about them.

Start making consistent deposits in your savings account

Having a financial cushion to help you through tough times in life is the basis of a financially-secured future. If you’re making a consistent income every week or every month, it’s time to start putting away a small chunk of it regularly into a separate savings account so that you have enough money saved up to cover any large unexpected costs or a financial disaster. Even if you make small contributions of $50 a week, you will have around $2400 by the time 2019 arrives.

Consolidate all your credit card debt through balance transfer

If you’re like any other average American who went a tad overboard with the shopping bill over the holiday season, you may have accrued some debt on your credit cards which might take some time to pay off. But keeping track of your debt is not easy if you have numerous credit cards in your possession.

An easy way to track all your credit card debt is by applying for balance transfer card which lets you consolidate all the debt on a single card with a 3 per cent commission fee of the entire balance. Make sure to read the fine prints before applying for a balance transfer card so that you know the true APR on your loan.

Clean your phone and email account

Tech devices are an important part of our lives which is why it is important to declutter them as well

Have you ever run into a frustrating storage problem when trying to download a new app or a song but you aren’t able to because there isn’t enough space on your phone? It happens so frequently to most of us and the only way to overcome this issue is by cleaning out your phone completely and transferring all the important photos and documents to cloud storage or your computer. This won’t just make heaps of space on your phone but also ensure that your precious data is backed up on cloud or another device in case something happens to your phone.

Similarly, you can also declutter your email account by unsubscribing from all the annoying newsletters that you don’t want to read. It can be quite frustrating to constantly get unnecessary email notifications from websites and can become a source of distraction.