Entrepreneurs know by experience just how tough and competitive being in the startup business ecosystem really is. With the need to dedicate much of their time to keep up with this industry, one can easily fall behind when it comes to their personal finances.

This shouldn’t be the case though. Business owners can definitely keep on track of their long-term goals such as buying a house or building their retirement fund while also growing or building a company. These are five ways they can do so, according to financial advisors.

Start with Goals

Knowing one’s personal financial goals will enable them to also know how much to save or invest to achieve them

As with every journey, one’s quest to stay on top of their finances should start with clear objectives in mind. Be it relatively short-term goals like saving up for a well-deserved trip or big-ticket purchases, an entrepreneur can work on other goals separate from their business goals.

It’s worth noting though that some may have trouble determining exactly what their plans are. These are the people who would benefit most from consulting with a certified financial planner for help. A planner can also guide a person about specific strategies they can employ to achieve their goals once they’ve been cleared.

The Core of Every Plan

And of course, no financial plan will be complete without a set budget. Financial experts consider this to be a core component of any plan. To create one, begin by taking note of all expenses and then look for opportunities to cut costs.

Most likely, these cuts would be taken out of an individual’s non-necessity expenditures such as going to the movies or dinners out with friends. Using financial apps like PocketGuard and Mint would be helpful in budgeting. Financial planners particularly recommend following the 50/30/20 approach. This entails allotting half or 50% of one’s spending money on needs, 30% on wants and the remaining towards savings.

Explore Numerous Investment Options

Cryptocurrencies like Bitcoin have gained popularity in recent years as high-return, high-risk investments

While growing one’s business is a way to grow wealth, investing in various appreciating assets is also a good way to do so. Depending on where a person is in life, they may be advised to take on more risky or conservative investments. Either way, people are still recommended to look into a variety of opportunities to put their money into such as IRAs, stocks, and bonds.

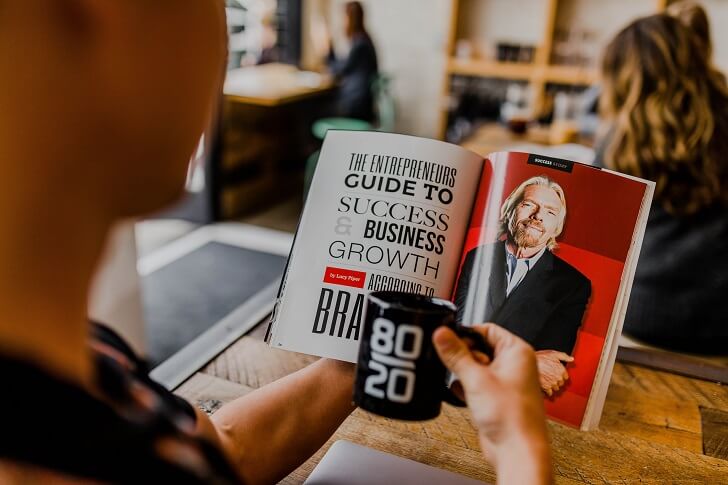

Never Stop Learning

Don’t neglect to read up on the latest financial news or read helpful books about the same topic

Just like managing a business, panning one’s own finances can be a challenging task. Thus, it’s important to keep learning to make things easier. One is recommended to stay updated about recent developments in the economy as a whole and surround themselves with people who can help them.