Let’s be honest! We don’t need research or study to tell us that struggles with money are linked to our mental health. They say money can’t buy happiness, but we’re sure you’ll agree when we say that it sure can buy some mental stability.

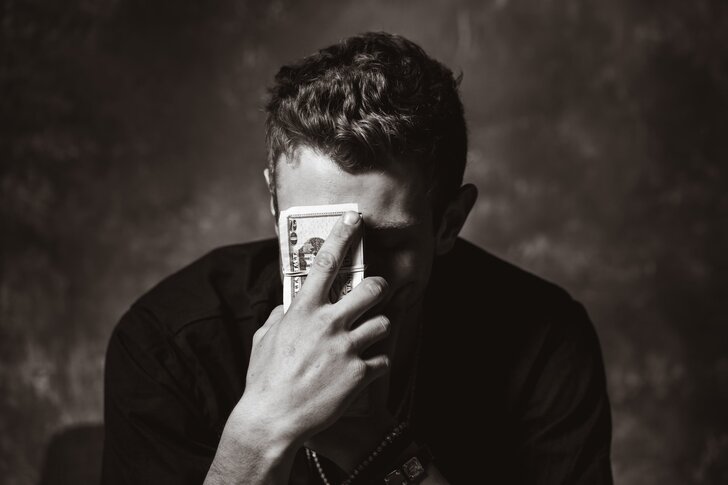

Travis Essinger/Unsplash | Studies reveal that a large number of people having debts deal with mental health issues

If you don’t believe us, maybe you’ll listen to the experts. The Royal College of Psychiatrists conducted a study that discovered that 50% of people having debts deal with mental health issues and money trouble. After all, when is a man more relaxed - when he’s struggling to make ends meet or if he has a sound bank balance?

The relationship between peace of mind and funds is complex and has a different effect on everyone. Sometimes it’s the money issue; sometimes, it’s just your mental issues. Whatever it is, we’re here to tell you that there’s no need to panic. Here’s some help you could use in your lowest times.

Identifying the issue

Most of the time, recognizing the real reason behind scarce resources can be tough, and you may need support to do so. There are a couple of things that people do that indicate their financial choices may be linked with their mental health.

- Do you spend large amounts of money on things you don’t need to make yourself feel better?

- Are there times where you can’t work due to poor mental health?

- Do you avoid opening or checking bills and bank statements?

- Do you dodge in-person conversations about your finances?

- Do you worry about making financial payments on a daily basis?

- Even if you’ve got enough money, are you worried about spending and debts?

- Do you find it hard to take in the required information in order to make a financial decision?

Not all of the above behaviors indicate that you’ve got a problem with your finances, but if you see even a few of them happening frequently, it’s possible that you could lose control of your money and build debt.

Katie Harp/Unsplash | If you spot distinct markers of links between your finances and your level of stress, know that you need to do something soon

How to work your finances

If you’re concerned about your financial decisions, here are a few simple actions you can implement right away.

- Lose the credit cards - Yes, you read that right! Credit cards can be tempting for online shopping, often, even unnecessarily. So get rid of the credit cards. The best part is that it won’t affect your credit score.

- Budgeting it all the way - It is hard work, but it’s worth it. Making a budget will help you get a clearer picture of your cash flow, and you’ll gradually be able to find little cash for unexpected expenses. This way, you don’t need to constantly worry about a rainy day.

- Talk about your debt - Whether you’re in debt or reaching close to it, you must talk about it to someone you trust. Seeking advice can prevent your mental health from getting worse. The earlier you seek support, the more confident you’ll be and the faster you’ll get out of debt.

Ales Nesetril/Unsplash | Credit cards can often pull you into spending more than you need to. Therefore, try to stay away from them if you're having money issues

Most importantly...

Regardless of whether or not you’re facing financial issues, it is important to make your mental health a priority. There are plenty of resources available on the internet and around your community. Please do not hesitate to reach out for help, because you’re not alone.